Sage 50 Payroll is a comprehensive software solution that has been engineered to simplify and automate the process of payroll for businesses of all kinds and sizes. The software ensures a wide range of features and functionalities that allows the user to manage the employee data, calculate wages and salaries, generate payslips, and also handle tax deductions with smoothness.

One of the major benefits of Sage 50 Payroll is the user-friendly interface, that makes it easy for even the non-technical users to be able to use and operate. This way one can quickly set up the company details, add employees, define pay rates, and customize the settings as per your unique requirements.

The software also makes sure of compliance with legal regulations. This is done by automatically calculating tax contributions according to the latest legislation. This helps the users to avoid costly errors while being on top of the payroll obligations.

Likewise, the Sage 50 Payroll offers various detailed reports that allows the users the various insights such as: labor costs, overtime expenses, leave accruals, and much more, thus enabling the user to make informed decisions related to the resource allocation.

So, you see, the process of Integration with E-banking takes efficiency one step ahead by allowing seamless electronic payments directly from within the software. With just a couple of clicks, the user can transfer funds securely to the employees’ bank accounts without the hassle of manual processes or even the paper checks.

Sage 50 Payroll is a powerful tool that allows the simplification of the payroll management through various intuitive features such as automated calculations and detailed reporting. This when combined with E-banking functionality, it further grows into an invaluable asset when it comes to streamlining payment transactions for better efficiency. Let’s take a further look into How to set up e-Banking in Sage 50 Payroll:

Sage 50 Payroll e-Banking: How to set up

In order to do this, you need to:

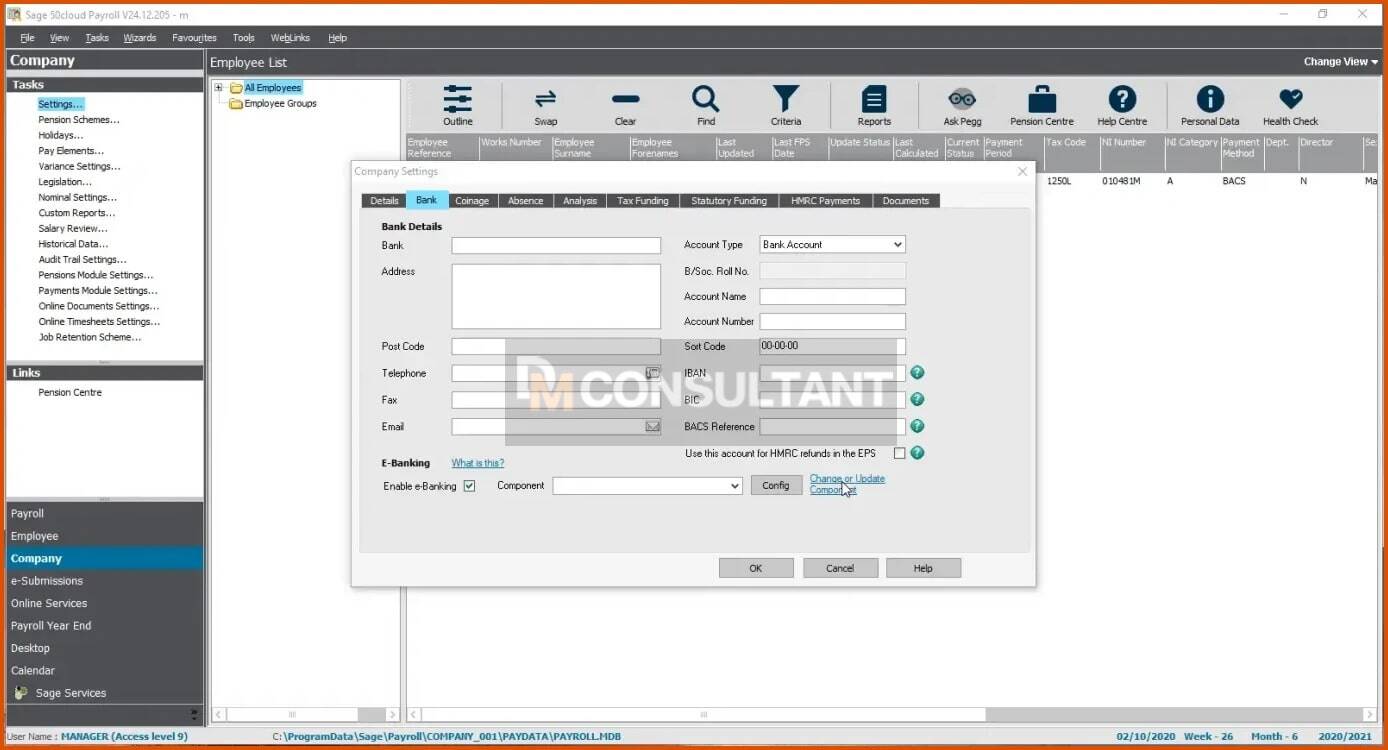

- Go to the Sage 50 Payroll head to Company

- Go to Settings

- Now, click on the Bank tab.

- Located at the very bottom of the screen select Enable e-Banking.

- After you have checked the enable e-Banking box, you are required to download the required component from the website.

- Finally, Click ‘Change or Update Component’ to do this.

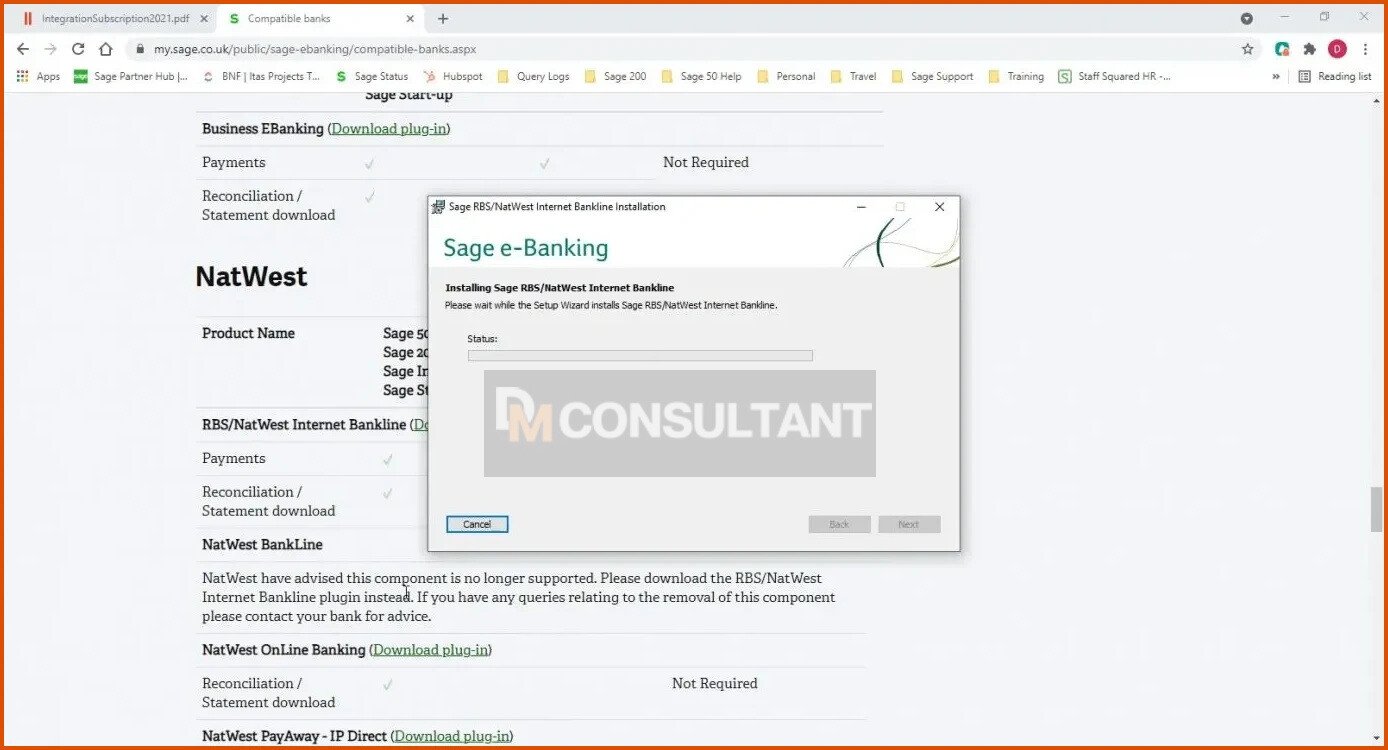

- Next, Select the component which is needed by you to from the two options towards the very bottom of the page.

- Now, locate the required plug-in that is needed for the e-Banking set-up and click Download Plug-in.

- After the file has been downloaded, select to launch the file which then prompts the Sage e-Banking to start installing the plug-in. Follow the simple steps through the installation process.

NOTE : There are certain plug-ins that require the Sage 50 Payroll to be shut while you go through the process of installation. In case you have received an error during installation, you need to shut the Sage 50 Payroll and click on retry.

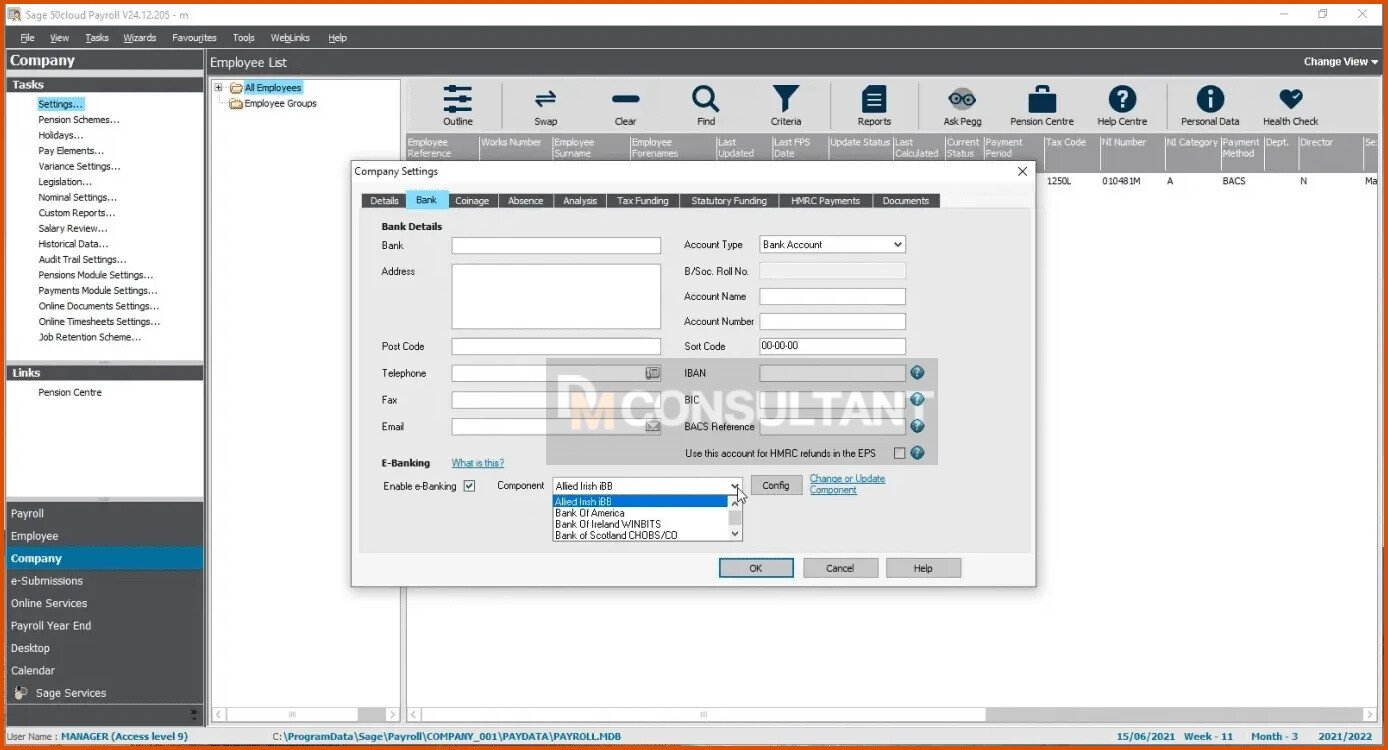

- After the plug-in has been installed, navigate back into Sage 50 Payroll and return to Company

- Now go to Settings

- Next click on the Bank options.

- Now you need to select the component you have just installed from the drop-down component list.

- Finally, click the config option next to the component that you have selected.

Alsi Checkout -> Sage 50 Accounting Could Not Be Started

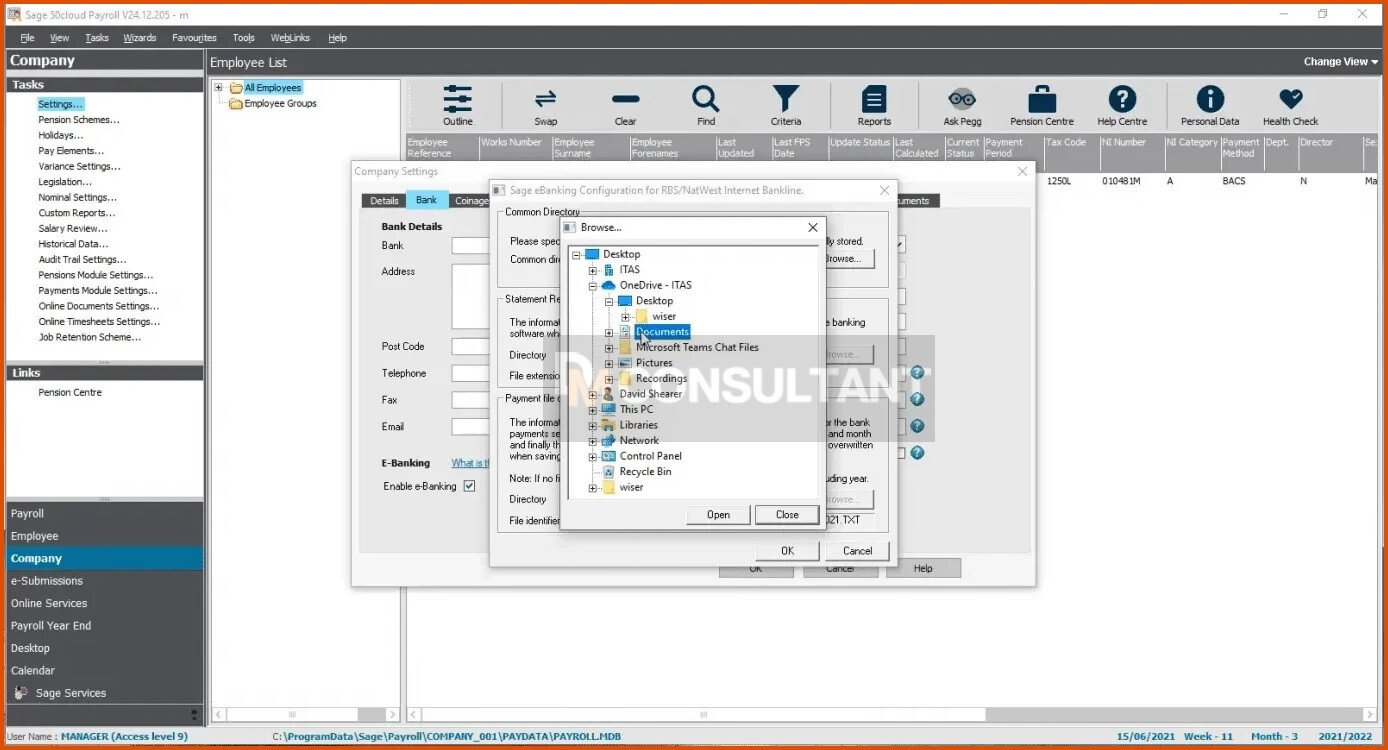

Here, you can see, that within the config, you are directing the software where you would like to save the payment file and the kind of file extension one would like to use.

In case you would like to change the common directory:

- You need to select the browse option with in that section

- Now select the folder you want to use,

- Now make sure that this is a secure location.

- One might also need to speak to the relevant bank about what file extension one will require and if a file identifier is required.

- After you have completed this click OK

- Now go back to the Bank option.

- From this location one should start populating your bank details information within the fields provided: including the account name, account number and sort code.

- BACS reference is optional, the user can leave it blank if they need to.

- Once done, click OK.

- The company has now been set up to produce the e-Banking file, next we need to set up the employees.

.jpg)

- Now Select Employee from the left-hand sidebar

- Next select Employee Record

- Now select the Banking tab. Within here you need to populate the account name, account number and sort code.

.jpg)

- Lastly, you need to go to the Employment tab and ensure that the Payment Method field has BACS selected as the payment method

- Finally click Save.

.jpg)

Top Tips When Using E-Banking Within Sage 50 Payroll

When it comes to using the e-banking on Sage 50 Payroll , there are various best practices that can help streamline the financial processes and maximize efficiency. Let us look at some tips to bear in mind:

- Set up secure access: Make sure that you have a strong password for your e-banking account and also enable two-factor authentication if available. This will add an extra layer of security in order to protect the financial data.

- Regularly reconcile the transactions: It is important to regularly compare the transactions recorded within Sage 50 Payroll with those within your bank statement. This will help recognise any discrepancies or errors and make sure of the accurate financial records.

- Keep software updated: You can now stay on top of updates for both Sage 50 Payroll and the banking software. These updates usually include: bug fixes, security enhancements, and the latest features that can enhance the functionality.

- Backup data regularly: Be sure to back up your payroll data as it is important in case of any unforeseen events or system failures. Ensure that you have a reliable backup system in place, whether it is cloud-based or external storage.

- Train employees on proper usage: In case you have multiple users operating the e-banking feature, you need to offer the required training sessions to make sure that everyone understands how to use it correctly and securely.

By following these best tips, one can easily optimize the use of e-banking on Sage 50 Payroll and maintain the smooth financial operations required for your business.

Tips For Enhanced Efficiency And Security With E-Banking

- Helps maintain the software up to date: Regularly updating your Sage 50 Payroll software is quite important for maximizing the efficiency and security when using e-banking features.The updates usually consist of important security patches and bug fixes that can help protect the financial data.

- Be sure to Use strong passwords: Make sure that you use strong, unique passwords for both your Sage 50 Payroll account and any online banking accounts that are connected to it. Avoid using any obvious or easily guessable passwords, such as birthdays or common words.

- Allow two-factor authentication: You need to know that the two-factor authentication offers an extra layer of security by offering a second form of verification, such as a code sent to your mobile device, in addition to the password when logging into your e-banking accounts.

- Regularly reconcile bank statements: Reconciling bank statements regularly helps make sure of the accuracy of the financial records and also identifies any discrepancies or unauthorized transactions promptly.

- Set user permissions carefully: Granting access to the e-banking feature within the Sage 50 Payroll should be done according to the need-to-know basis. Only offer access to the trusted individuals who need it for their job responsibilities.

- Monitor account activity regularly: Keep an eye on all e-banking transactions within Sage 50 Payroll and also verify them against bank statements or online banking platforms on a regular basis.

When you follow these tips, you can enhance the efficiency and security of utilizing the e-banking within the Sage 50 Payroll while safeguarding sensitive financial details from potential threats or also unauthorized access.

Troubleshooting Of Common Issues With E-Banking On Sage 50 Payroll

Are you having trouble with E-banking on Sage 50 Payroll? Well, this is quite common. While this feature can easily streamline the payroll processes and also helps save you time, it is not without its own set of challenges.

One common problem that the users usually face is difficulty linking their bank account to Sage 50 Payroll. This can be quite frustrating, however there are a couple of things you can also try:

- Firstly make sure that your bank supports the E-banking integration with Sage 50 Payroll.

- If they do, double-check that you have entered all the required details correctly.

The other major problem that can arise are the errors when importing or exporting data within your bank and Sage 50 Payroll. This could be because of the formatting problem or mismatched data fields. Make sure that you are using the relevant file types and check that the data within both systems aligns properly.

At times, the transactions might fail to sync between Sage 50 Payroll and the bank account. In such cases, check for any error messages or notifications from either system that can provide clues as to what went wrong.e

If all else fails and you are still unable to resolve the problem on your own, do not hesitate to reach out to customer support for assistance. Hence, by troubleshooting these common problems with E-banking on Sage 50 Payroll proactively, you will be better equipped to overcome any hassles that come your way, thus, allowing you to enjoy the convenience of electronic banking while making sure of accuracy within your payroll processes.

Conclusion

In the current digital age, setting up e-banking on Sage 50 Payroll can greatly enhance the payroll processes and also the efficiency. By better understanding the functionalities of Sage 50 Payroll and also exploring the alternative options for e-banking, following best practices, and the applied tips for better efficiency and security, one can make the most out of this feature.

Lastly, Sage 50 Payroll provides a user-friendly software that allows the user to easily manage the employee payments through electronic banking. In case you choose to utilize their integrated e-banking service or explore alternatives such as integrating with the bank’s online banking system or also using the third-party software solutions, there are many options available according to the specific requirements.

How to set up e-Banking in Sage 50 Payroll? So you see, when setting up e-banking on Sage 50 Payroll, you can revolutionize the manner in which you manage the payroll processes in terms of speed, accuracy, and convenience. By accepting the technology and taking advantage of these advanced features, one can also streamline their financial operations and focus more on the ever growing business.

FAQs for How to set up e-Banking in Sage 50 Payroll

Q. I wish to use e-banking but it has been grayed out, do I have full access rights?

A. In this case you are required to enable e-banking first by going:

- Go to Company

- Go to Settings

- Go to the Bank option and tick to enable e-banking.

Q. How can one pay a percentage of an employee’s wage into two different bank accounts?

A. For this, you need to go within the employee record located in the banking tab. Here You can add a second account.

Q. Why is the format that my bank is requesting is not the same as what Sage has produced?

A. There are a number of different plug-ins that are available and sometimes a bank can also offer variations of the plugin.

Q. Is it possible to set the directory where I want my file to be saved instead of browsing it each time?

A. Yes,This can easily be set under:

- Go to Company

- Go to Settings

- Got to Bank

- Now go to E-banking

- Now click on Config.

When you browse to the directory path it is important for your file to be saved in the top Common Directory box your file will default to this location. This can still be fixed when saving.

Q. Can one pay the employees directly through payroll without logging on and uploading a file?

A. Yes, it is important as using the standard e-banking method is not possible. Hence It is a manual process of saving the file and then uploading it on to your bank.