Sage Intacct and Chargebee Integration is one of the current important aspects when it comes to Sage users. For most businesses across the globe, the application of Sage Intacct as their financial accounting system is used to store, manage, and balance the transactions and the details that manage the company’s finances. Here, Chargebee integrates with Intacct to sync the invoices and import A/R data to reduce the manual efforts involved in managing your finances.

Take Note:

- This integration applies only to Performance and Enterprise plans.

- Chargebee has been listed within Intacct’s Marketplace. The user can integrate their Chargebee site with Intacct using Chargebee’s license, or they can also choose to integrate using their own web services developer license.

- The integration of Chargebee with Intacct supports the multi-decimal feature.

Overview of Sage Intacct and Chargebee Integration

This process of sync is a one-way integration of sales invoices from Chargebee to Intacct. Bear in mind that Sync runs once every 24 hours.

The Single-Entity and Multi-Entity Sync

One can connect their Chargebee site either with a specific entity within Intacct or they can also connect with the Top Level. All the objects: Customers, Products, Coupons, Invoices, Credit Notes, Refunds, and as such will have one-way sync.

| Invoice | Sales Invoice |

| Credit Note | Sales Credit Memo |

| Transaction | Payment->Payment refund -> Vendor Payment |

| Taxes | Subtotal Tax |

| Customers | Customers |

| Plans Addons | Items |

| Coupons | Negative items |

The AR Invoice Workflow

Chargebee supports integration that comprises Single-Entity mapping for AR invoices.

- The AR Invoices and Credit notes refer to the GL Account group with tax details for each line item.

- It also Supports both the workflow of countries that include tax solutions and also without tax solutions.

| Invoice | Sales Invoice |

| Credit Note | Sales Credit Memo |

| Transaction | Payment->Payment refund -> Vendor Payment |

| Taxes | Subtotal Tax |

| Customers | Customers |

| Plans Addons | Items |

| Coupons | Negative items |

Take Note

In case the customer chooses the top-level entity then the entity’s base currencies should be the same to be able to sync. In case they have multiple entities with different base currencies then it is recommended to have Chargebee sites for every entity and connect the same with Intacct.

Customers

- The Customer records available in Chargebee are created within Sage Intacct.

- As for the Existing customers, their records are identified and mapped by Customer ID.

Products

- The Plans/Addons are created in the form of Items in Intacct.

- In case the Items are previously present in Intacct, then the Item SKU can be entered within Plans/Addons in Chargebee to avoid duplication.

The Coupons

- Coupons or discounts are created as negative items.

The Invoices

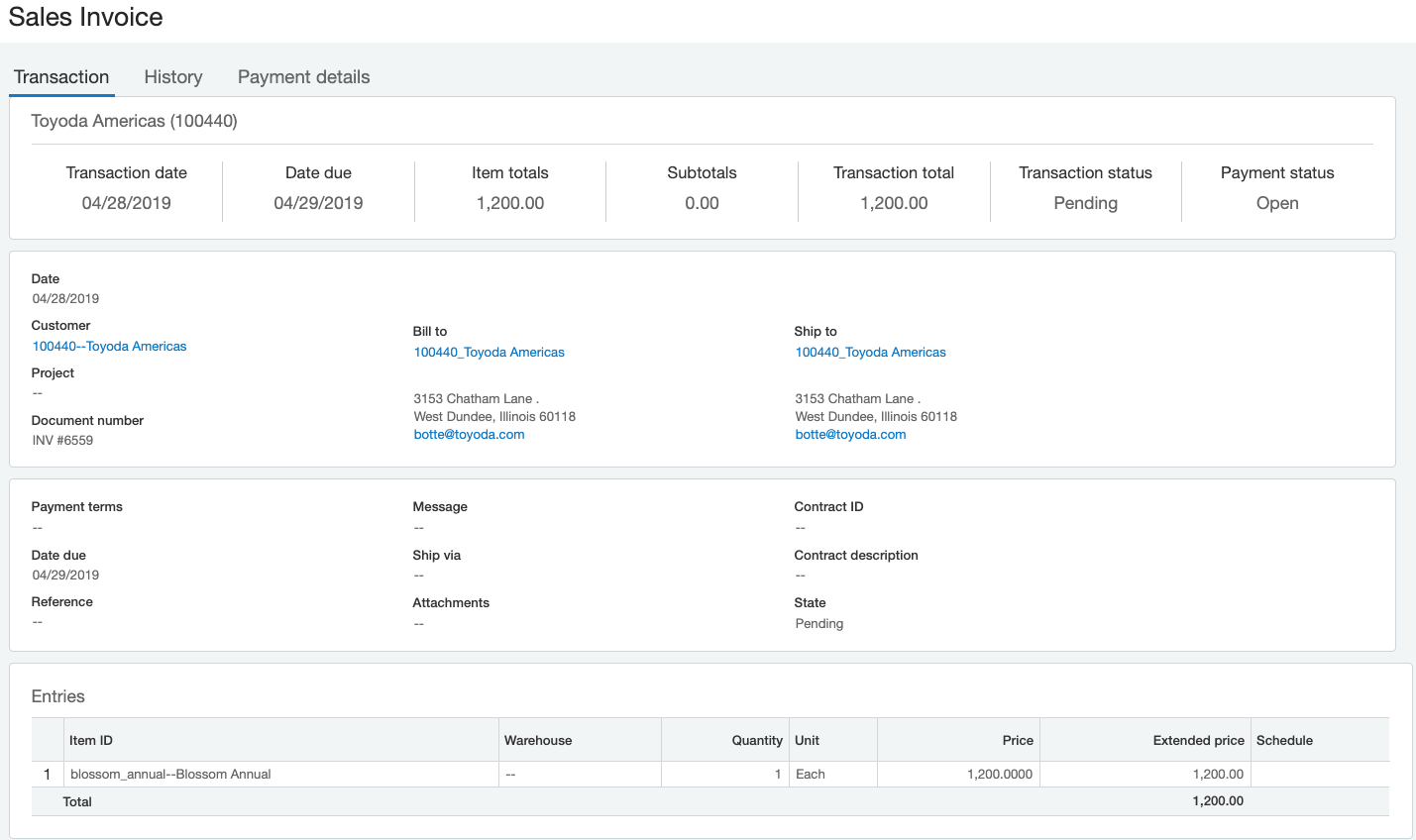

The users need to know that the Invoice flow when the tax solution is disabled:

- Invoices are created as Sales Invoices within Intacct.

- Once an invoice is voided in Chargebee, a Credit Memo is created in Intacct and linked to the invoice.

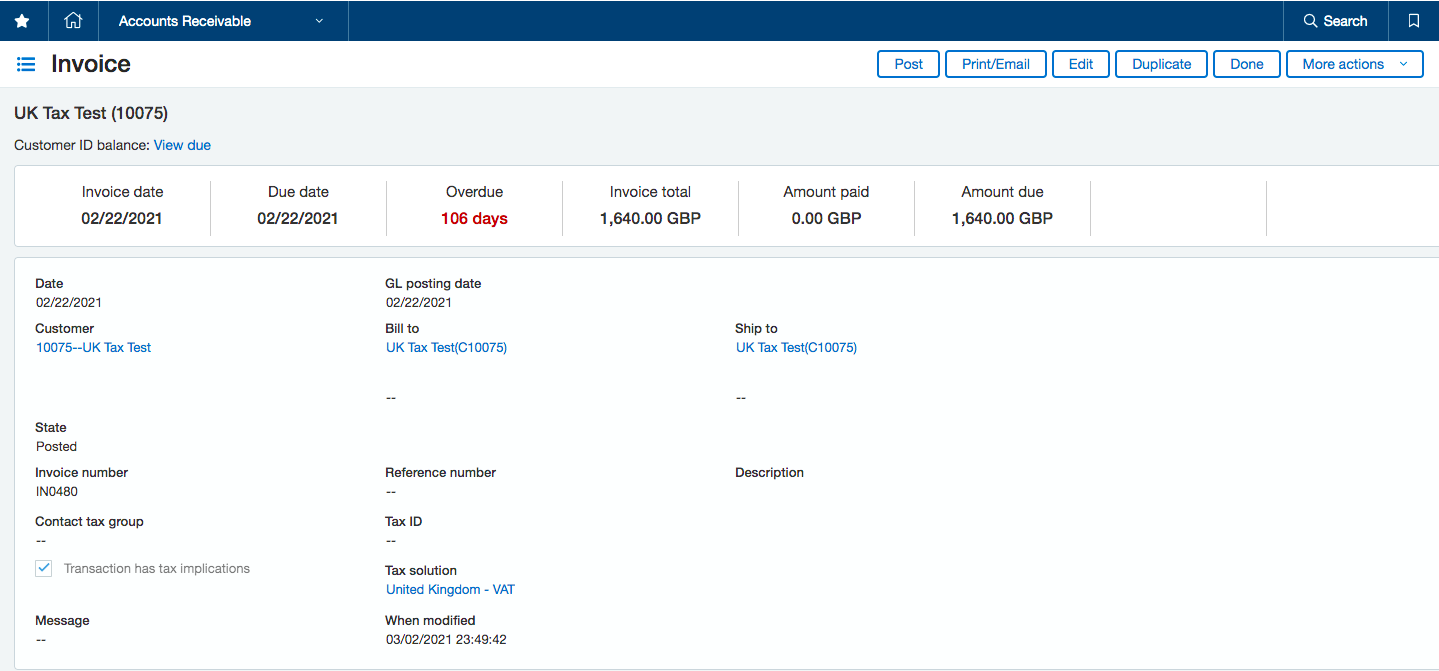

The Invoice flow when the tax solution is enabled

- As part of the process of integration, the AR invoice is directly created within Intacct using the posting configuration as defined within the transaction definition.

- Once an invoice is voided in Chargebee, a negative AR invoice is created within Intacct when Tax Solutions is enabled.

The Credit Notes

- Credit notes are created in the form of Sales Credit Memos within Intacct.

- Likewise, the Credit notes are created as Negative AR within Intacct if the Tax Solution has been enabled.

- Once a Credit note has been voided within Chargebee, a corresponding action within Intacct is not present. In this case, the user can choose to delete the document within Intacct manually or list this Credit Memo as a sync error.

The Refunds

- Refunds can be created as Vendor payment within Intacct or Accounts Payable ledger.

- In case the user has a Vendor available within Intacct, they can provide the Vendor name during the process of configuration and Chargebee will create refunds as Payments against this Vendor.

- Likewise, Chargebee can also create a Vendor automatically (CB_REFUND_VENDOR) and use this for the process of refund transactions.

- Once a refund has been created, it will debit the CB_REFUND_VENDOR account and credit the Bank Account.

To adjust the AR balance for the customers, the users should do the following:

- To Create an AR adjustment debit memo. This will debit AR and credit CB_REFUND_VENDOR.

- Apply the credit memo to the debit memo.

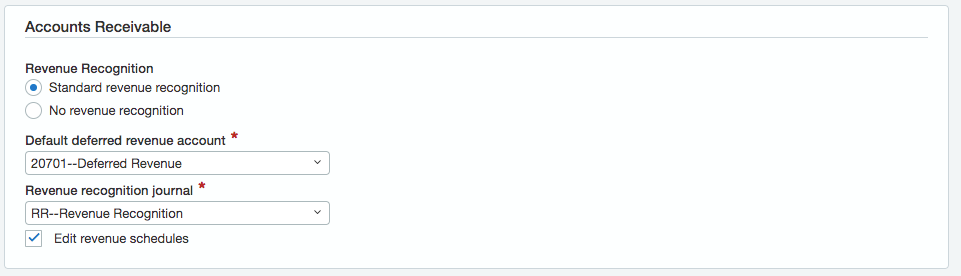

The Revenue Recognition

Revenue recognition is another aspect when it comes to Sage Intacct and Chargebee Integration. The user needs to enable Revenue Recognition at the AR invoice for the process of configuring the Tax Solutions.

Take Note

This process is a pre-requisite in case the Tax solution has been enabled as part of the configuration offered and if the user has purchased the revenue recognition module in Intacct.

Below are the steps to enable Revenue Recognition at AR invoice:

- Start by Selecting Company>Admin> Subscriptions> Revenue Management> Configure

- After this, Select Standard Revenue Recognition

- In case the users are using Intacct’s revenue recognition module, then they can enter the revenue recognition template ID in case of Plans/Addons, One-time charges, Setup fees, Discounts, Bad debts, and Round in Chargebee during the process of configuration. Here, Chargebee sends the invoice line amount, start date, and end date once an invoice has been synced to Intacct. According to the revenue recognition rules configured within Intacct, the revenue forecast schedule is then generated in Intacct.

- Nevertheless, in case the user does not have revenue recognition support in Intacct, they can download Chargebee’s revenue recognition, deferred revenue reports and manually and also enter the consolidated value in Intacct.

Take Note

- In case they have configured the selected plan/add-on prices and quantities using multiple decimal places, Chargebee then syncs the subscription and invoice data over to Intacct. Thus, incorporating the multiple decimal values as applicable.

- While Chargebee supports up to 20 decimal places, the number of decimal places shown within the accounting system is also according to what is supported by Intacct.

Also Checkout -> Sage Intacct Service Trade Integration

Terminology of Sage Intacct and Chargebee Integration

Dimensions: For custom tracking/reporting, the user can offer additional information at a customer or product level, namely Dimensions in Intacct. Bear in mind that the following dimensions are supported: Location, Class, Department, Vendor, Project, and Employee.

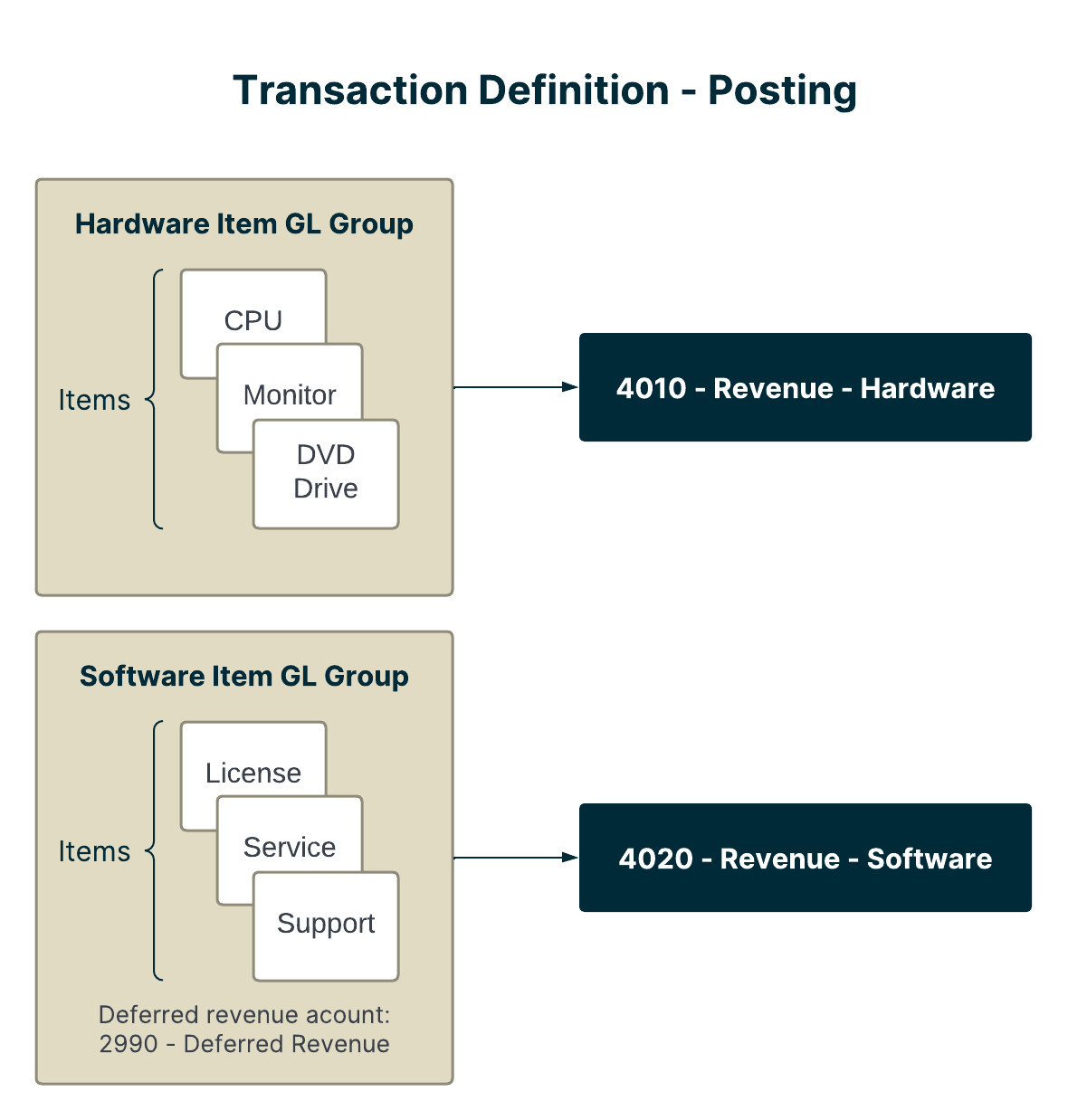

Item GL Group: Every Item GL Group comprises a default Revenue and Deferred Revenue Account associated, with Intacct. One can use item GL groups to categorize items and post transactions over to specific GL accounts. In case you are selling products/services that should map over to the Revenue/Deferred Revenue Account, then the user can create a group and map the products accordingly. For example: the user can create Item GL groups Software and Hardware, and then select a group name when mapping line items within Chargebee.

GL Account Group: A GL Account group can comprise a GL Account and/or Dimensions and/or other GL Account groups.

Product Line: One can offer a product family name for items created/mapped from Chargebee. In case you have multiple Chargebee sites, one can categorize the items by offering a Product Line in Chargebee.

Conclusion

So, there you have it friends, this is all that we have on Sage Intacct and Chargebee Integration. How did you like the article? Was it helpful? Do let us know in the space below and we would love to hear from you.

FAQ For Sage Intacct and Chargebee Integration

Q. When the organization creates Sales Orders for fulfillment, how does this work as part of this integration?

A. Sales Orders are not created as part of the integration. The user should know that the Sales invoices are only created once they are synced from Chargebee.

Q. Is the tax solution module supported?

A. Yes, Tax Solution is supported by creating the AR invoice and not the Sales Invoice

Q. Does Sage Intact have an API?

A. Yes, Integration APIs are built within the Sage Intacct system.

Our Top Integration Services for Sage Intacct